Are you tired of feeling overwhelmed by your financial situation? Do you find it challenging to make ends meet and achieve your financial goals? If so, it's time to take control of your finances by creating an effective personal budget. Understanding where your money goes and having a plan in place can help you regain financial stability and achieve the life you desire.

Unleash the Power of Planning:

Creating a personal budget is more than just tracking your income and expenses. It's a strategic plan that allows you to allocate your resources wisely and achieve your financial goals. By determining your priorities and setting clear objectives, you'll gain a new level of financial freedom.

Discovering the Power of Awareness:

To create a successful personal budget, it's vital to have a clear understanding of your current financial situation. By carefully examining your income and expenses, you'll gain valuable insights into your spending habits and identify areas where you can make adjustments. This newfound awareness will empower you to make better financial decisions and achieve your financial goals faster.

Empowering Yourself with Smart Saving Strategies:

One of the key elements of an effective personal budget is setting aside money for savings. While it may seem challenging, saving is an essential aspect of achieving financial security. By implementing smart saving strategies and making small adjustments to your spending habits, you'll be amazed at how quickly your savings grow and how much closer you'll be to achieving your long-term goals.

Master the Art of Strategic Spending:

Creating a personal budget doesn't mean sacrificing all the things you love. It's about being strategic with your spending and aligning your expenses with your priorities. By identifying your needs versus wants and making conscious choices about where your money goes, you'll be able to enjoy the things that bring you joy without compromising your financial stability.

Harness the Power of Accountability:

An effective personal budget requires commitment and discipline. Creating accountability for yourself will help you stay on track and make your financial goals a reality. Whether it's regularly reviewing your budget, seeking guidance from a financial advisor, or finding an accountability partner, having someone to support and motivate you will greatly increase your chances of success.

Creating an effective personal budget is not an overnight process, but with dedication and perseverance, it is an achievable goal. By utilizing these strategies and investing time and effort into your financial well-being, you'll be on your way to a more secure and prosperous future.

Understanding Your Financial Objectives

When it comes to managing your finances effectively, it is crucial to have a clear understanding of your financial goals. Defining your financial objectives will serve as the foundation for creating a successful personal budget. By identifying what you want to achieve financially, you can tailor your budget to prioritize and allocate your resources accordingly.

- Reflect on Your Priorities: Begin by reflecting on what matters most to you. Consider short-term and long-term goals, such as purchasing a home, saving for retirement, or paying off debt. This will help you determine the areas where you should focus your financial efforts.

- Set SMART Goals: Once you have identified your priorities, it is essential to set specific, measurable, attainable, relevant, and time-bound (SMART) goals. SMART goals ensure that your financial objectives are realistic and provide a clear roadmap for achieving them.

- Evaluate Income and Expenses: Take a comprehensive look at your income and expenses to understand your current financial situation. Analyze your sources of income, fixed expenses (such as rent or mortgage payments), variable expenses (such as groceries and entertainment), and any outstanding debts. This evaluation will help you determine how much you can allocate towards each financial goal.

- Consider Your Risk Tolerance: It is important to consider your risk tolerance when setting financial objectives. Some individuals may have a higher tolerance for investment risks, while others may prefer more conservative approaches. Understanding your risk tolerance will influence your decisions regarding savings, investments, and other financial strategies.

- Regularly Review and Adjust: Financial goals are not set in stone. It is crucial to regularly review your objectives, reassess your priorities, and adjust your budget accordingly. As circumstances change and new opportunities arise, adapting your financial plan will ensure that it remains aligned with your overall goals.

By understanding your financial goals and incorporating them into your personal budget, you can take control of your finances and make informed decisions that will help you achieve long-term financial success.

Assessing Your Income and Expenses

Understanding your financial situation is crucial when it comes to creating an effective personal budget. This section will guide you through the process of assessing your income and expenses, giving you a clear picture of your financial resources and spending habits.

Evaluating Your Income

Begin by identifying all sources of income that contribute to your financial well-being. This includes not only your primary job but also any additional sources such as freelance work, investments, rental income, or government benefits. Take note of the frequency and amount of each income source to calculate your total monthly income.

Ensure that you consider both regular and irregular income, as irregular income can present challenges in budgeting.

Analyzing Your Expenses

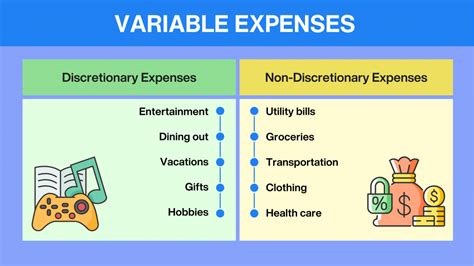

Next, examine your expenses to gain a comprehensive understanding of how you allocate your money. Categorize your expenses into fixed, variable, and discretionary categories.

Fixed expenses include recurring payments such as rent/mortgage, utilities, and insurance, which remain relatively stable from month to month.

Variable expenses include flexible expenses like groceries, transportation, and entertainment, which can vary significantly from month to month.

Discretionary expenses are non-essential purchases that are not necessary for your basic needs, such as dining out, hobbies, or vacations.

Track your expenses over a few months to capture any irregular or unexpected expenses that may not occur every month. This will give you a more accurate representation of your spending habits.

Calculating Your Net Income

To assess the overall health of your budget, subtract your total expenses from your total income. This will give you your net income, which reflects the amount of money remaining after all expenses have been paid. If your net income is positive, you have a surplus, whereas a negative net income indicates a budget deficit.

A positive net income allows you to allocate funds towards savings or debt payments, while a negative net income calls for adjustments to your spending habits or seeking additional sources of income.

By thoroughly evaluating your income and expenses, you can gain a clear understanding of your financial situation. This knowledge will serve as a strong foundation for creating a successful personal budget that aligns with your financial goals and helps you achieve financial stability.

Identifying Non-Essential Expenditures

One crucial aspect of managing your financial resources effectively is recognizing and distinguishing between essential and non-essential expenses. By identifying and evaluating your non-essential spending habits, you can gain a clearer understanding of where you may be overspending and make more conscious choices to optimize your personal budget.

| Step 1: | Track your expenses |

| Step 2: | Analyze your spending patterns |

| Step 3: | Identify non-essential expenditures |

| Step 4: | Consider alternatives |

| Step 5: | Set priorities |

Begin by tracking your expenses for a determined period, whether it be a week, a month, or longer. This will allow you to gain insight into your spending habits and identify patterns. Analyze these patterns to determine where your money is primarily going and highlight any areas where non-essential spending is taking place.

Once you have identified your non-essential expenditures, it is essential to consider alternatives. For example, you might find that dining out frequently is a significant portion of your budget. In this case, you could explore options such as cooking at home more often, meal planning, or seeking affordable dining options.

Setting priorities is another vital step in managing non-essential spending. By evaluating your values and financial goals, you can make informed decisions about where to allocate your funds. This might mean cutting back on certain discretionary expenses to allocate more money toward savings or other essential areas of your budget.

Identifying and assessing your non-essential spending habits is a fundamental part of creating an effective personal budget. By being mindful of where your money is going and making conscious choices, you can gain better control over your finances and work toward achieving your financial goals.

Developing a Feasible Financial Plan

When it comes to managing your financial resources effectively, one essential step is to establish a practical and workable financial plan. This section will provide guidance on how to create a budget that accurately reflects your income, expenses, and financial goals.

Prioritizing Saving and Debt Repayment

One crucial aspect of managing your finances effectively is placing a high priority on saving and debt repayment. This section will provide you with valuable insights on how to prioritize these two financial goals, enabling you to create a sustainable and secure financial future.

When it comes to saving, it is essential to consider both short-term and long-term goals. Short-term savings can be used to cover unexpected expenses or emergencies, while long-term savings are crucial for retirement or larger financial goals such as purchasing a house or starting a business. By allocating a certain percentage of your income to savings each month, you can gradually build up a substantial reserve and protect yourself from financial setbacks.

Another important aspect of prioritizing saving is to explore different saving options. Research and compare various savings accounts, investment opportunities, and retirement plans to find the most suitable options for your needs. By diversifying your saving strategies, you can maximize your returns and ensure that your money is working for you in the best possible way.

In addition to saving, it is crucial to prioritize debt repayment. High-interest debts, such as credit card debts or personal loans, can quickly accumulate and become a financial burden. Developing a plan to pay off these debts systematically can help you regain control of your finances and save significant amounts of money on interest payments. Consider allocating a portion of your monthly budget specifically for debt repayments and focus on paying off debts with the highest interest rates first. As you eliminate each debt, redirect the freed-up funds towards paying off the next debt in line, creating a snowball effect that accelerates your debt repayment journey.

By effectively prioritizing both saving and debt repayment, you can take control of your financial future, achieve your financial goals, and ensure long-term financial stability and security.

Setting SMART Financial Goals

In the journey towards achieving a successful and well-managed financial future, setting SMART financial goals plays a vital role. These goals serve as guideposts that enable individuals to prioritize their spending, savings, and investment decisions, allowing them to make progress towards their long-term aspirations.

Specific: To start, it is crucial to establish specific financial goals that are clearly defined. Whether it's saving for retirement, purchasing a home, or building an emergency fund, being specific about what you want to achieve will provide direction and focus to your budgeting efforts.

Measurable: It is essential to set financial goals that are measurable in order to track your progress. Assigning specific numbers, such as saving a certain amount each month or reducing your debt by a certain percentage, allows you to evaluate your achievements and make adjustments to your budget as necessary.

Achievable: While it is important to aim high, it is equally important to set financial goals that are achievable within your current financial situation. Analyze your income, expenses, and debts realistically to ensure that your goals are attainable, as setting unrealistic objectives may lead to frustration and derail your budgeting efforts.

Relevant: Your financial goals should align with your long-term aspirations and values. Whether it's providing for your family, starting a business, or funding your children's education, your goals should be relevant to your personal circumstances and objectives.

Time-Bound: Setting a time frame for achieving your financial goals is crucial for maintaining focus and motivation. By establishing deadlines, whether short-term or long-term, you create a sense of urgency and hold yourself accountable to work towards your objectives in a timely manner.

By incorporating these SMART financial goals into your personal budgeting process, you can develop a clear roadmap for achieving financial success and ensure that your financial decisions align with your priorities.

Keeping Track of Your Expenses

Having an awareness of your spending habits is essential for effectively managing your finances. Keeping track of your expenses allows you to understand where your money is going, identify areas where you can cut back, and make informed decisions about your budget.

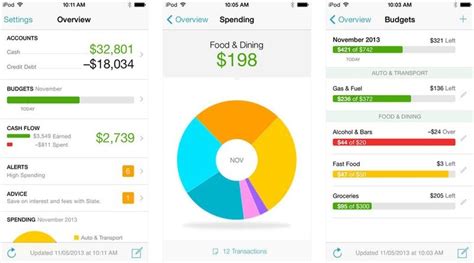

One way to track your expenses is by maintaining a detailed record of your purchases and payments. This can be done by using a budgeting app or a spreadsheet to document each expense, including the date, description, amount, and category. By consistently documenting your expenses, you will have a clear picture of your overall spending patterns.

Another useful method for tracking expenses is by using cash envelopes or designated spending categories. This involves allocating a certain amount of cash for specific categories, such as groceries, entertainment, or transportation. By physically separating your money into different envelopes or accounts, you can easily monitor how much you have left to spend in each category, and it serves as a visual reminder to stick to your budget.

Additionally, consider reviewing your bank and credit card statements regularly. This will allow you to identify any unauthorized charges or errors, as well as track your spending habits. Many banks also offer online tools and features that categorize your expenses automatically, providing you with a comprehensive overview of your spending.

Tracking your expenses not only helps you stay within your budget, but it also enables you to set realistic financial goals and work towards achieving them. By understanding where your money is going, you can make adjustments to your spending habits and prioritize your financial objectives.

In conclusion, keeping track of your expenses is a crucial step in creating an effective personal budget. Whether you choose to use technology, cash envelopes, or review statements, finding a tracking method that works for you will provide valuable insights into your spending habits and help you achieve your financial goals.

Finding Strategies to Minimize Expenses

One crucial aspect of managing personal finances is to identify effective techniques to reduce costs and increase savings. By exploring innovative approaches to cutting down expenses, individuals can achieve financial stability and meet their goals. The following tactics can help create a budget-friendly lifestyle:

- Embrace frugal living: Embracing a frugal lifestyle allows individuals to prioritize their spending and avoid unnecessary expenses. This includes making wise choices when it comes to purchasing products and services and seeking alternatives that align with the budget.

- Trim discretionary spending: Assessing and reducing discretionary spending, such as dining out, entertainment, and luxury purchases, is an effective way to save money. Exploring affordable alternatives or finding ways to enjoy leisure activities without breaking the bank can significantly impact the budget.

- Lower utility bills: Conserving energy and water can contribute to substantial cost savings. Implementing simple practices such as turning off lights when not in use, using energy-efficient appliances, and being mindful of water usage can result in reduced utility bills.

- Shop smart: Comparing prices, using coupons, and taking advantage of sales and discounts can help individuals make the most out of their budget. Additionally, opting for generic brands, buying in bulk, and researching before making a purchase are valuable techniques for saving money.

- Reevaluate subscriptions and memberships: Regularly assessing subscriptions and memberships is essential to avoid unnecessary expenses. Canceling unused or non-essential subscriptions can free up extra funds that could be allocated towards more important financial goals.

- Minimize transportation costs: Exploring alternative transportation methods, carpooling, utilizing public transportation, or biking can reduce transportation expenses. These approaches not only save money but also contribute to environmental sustainability.

- Meal planning and cooking at home: Planning meals in advance, cooking at home, and bringing lunch to work or school can significantly decrease food expenses. Additionally, reducing food waste and incorporating affordable ingredients can further optimize the budget.

By incorporating these cost-cutting strategies into daily routines, individuals can take control of their finances and allocate resources towards achieving long-term financial goals. Small savings accumulate over time and can make a significant difference in personal financial stability.

Enhance Your Budgeting Experience with Tools and Apps

In today's digital age, there are numerous resources available to assist you in managing your finances and creating an effective budget. By leveraging the power of budgeting tools and apps, you can take control of your personal finances and pave the way towards financial success. These innovative solutions offer a range of features and functionalities that can simplify the budgeting process and provide you with actionable insights.

Streamline Your Budgeting Process

One of the primary benefits of using budgeting tools and apps is that they streamline the budgeting process. These tools automate various aspects of budgeting, such as tracking expenses, categorizing transactions, and creating spending reports. With just a few taps, you can easily input your financial data and gain a comprehensive overview of your income and expenses. This automation saves you valuable time and ensures that your budget is always up to date.

Monitor and Track Your Progress

Another advantage of utilizing budgeting tools and apps is the ability to monitor and track your financial progress. These tools provide visual representations of your spending patterns, allowing you to identify areas where you may be overspending or saving. Additionally, the ability to set financial goals and track your progress towards them can help motivate you to stay on track and make informed financial decisions.

Access to Financial Insights

Budgeting tools and apps often offer advanced analytics and financial insights that can provide valuable information about your spending habits. These insights may include personalized recommendations for optimizing your budget, identifying potential savings opportunities, and predicting future expenses. By leveraging these insights, you can make more informed financial decisions and adjust your budget accordingly.

Collaborate and Sync with Others

If you share finances with a partner or family members, budgeting tools and apps offer collaborative features that enable seamless coordination. With these tools, you can easily sync your budget with others and track shared expenses. This not only enhances transparency and communication but also ensures that everyone is on the same page when it comes to financial goals and spending habits.

Security and Protection

When it comes to managing your personal finances, security is paramount. Budgeting tools and apps prioritize the protection of your financial data through advanced encryption and authentication measures. By using these tools, you can rest assured that your sensitive information is safeguarded from unauthorized access, providing you with peace of mind as you manage your budget.

In conclusion, budgeting tools and apps offer a range of features and benefits that can revolutionize the way you manage your personal finances. By leveraging these innovative solutions, you can streamline your budgeting process, monitor your progress, gain valuable insights, collaborate with others, and ensure the security of your financial information. Embrace the power of technology to take control of your budget and pave the way towards financial success.

Reviewing and Adjusting Your Budget Regularly

Regularly reviewing and adjusting your budget is an essential practice for maintaining financial stability and achieving your financial goals. By regularly assessing your budget, you can ensure that it remains effective and aligned with your changing needs and circumstances.

One important aspect of reviewing your budget is to analyze your income and expenses. Take time to evaluate your sources of income and identify any potential changes or fluctuations. Similarly, scrutinize your expenses and categorize them into essential and non-essential expenditure. This will help you understand where your money is going and identify areas where you may need to make adjustments.

As you review your budget, compare your actual spending with your budgeted amounts. This will allow you to determine whether you are staying within your planned limits or overspending in certain areas. Identify any discrepancies and ask yourself if there are any necessary adjustments or if you can cut back on certain expenses to better align with your financial goals.

In addition to assessing your income and expenses, it is crucial to consider any potential financial changes or upcoming events that may impact your budget. This may include an increase in rent or mortgage, a change in job or salary, or upcoming major expenses such as education fees or medical bills. By anticipating these changes, you can proactively adjust your budget to accommodate them and avoid any financial stress.

Once you have completed a thorough review of your budget, make the necessary adjustments to ensure it remains effective and realistic. This may involve reallocating funds from one category to another, renegotiating bills or subscriptions, or finding ways to increase your income. Remember that a budget is not set in stone, and it should be flexible enough to adapt to your changing circumstances.

| Tips for Reviewing and Adjusting Your Budget: |

|---|

| 1. Regularly assess your income and expenses |

| 2. Categorize your expenses into essential and non-essential |

| 3. Compare actual spending with budgeted amounts |

| 4. Anticipate and plan for potential financial changes |

| 5. Make necessary adjustments to your budget |

FAQ

Why is it important to track expenses when creating a personal budget?

Tracking expenses is crucial when creating a personal budget because it provides insight into your spending habits and helps you identify areas where you can cut back or save. By keeping a record of every expense, no matter how small, you'll have a clear understanding of where your money is going and whether it aligns with your financial goals. Tracking expenses also allows you to see any unnecessary or impulsive spending patterns that may be hindering your financial progress.

How can setting financial goals contribute to creating an effective personal budget?

Setting financial goals plays a significant role in creating an effective personal budget as it provides a clear direction for your spending and saving habits. When you have specific goals, such as saving for a down payment on a house or paying off high-interest debts, it allows you to prioritize your spending by focusing on what's important to you. By incorporating your financial goals into your budget, you can allocate a certain amount of your income towards achieving those goals, ensuring you make progress and stay motivated.

What should one consider when creating a realistic personal budget?

When creating a realistic personal budget, there are several factors to consider. Firstly, you need to take into account your income - calculate your monthly or yearly earnings after tax. Next, list all your necessary expenses such as rent/mortgage payments, utilities, groceries, transportation, and loan repayments. Subtracting these expenses from your income will give you an idea of how much disposable income you have. It's important to leave room for savings and unforeseen expenses as well. Consider any debts you need to pay off and allocate a certain amount for savings each month. Lastly, be honest with yourself about your spending habits and set realistic limits in each category. It's essential to strike a balance between covering your needs and allowing yourself occasional wants while still saving for your financial goals.