Enter the realm of London's prestigious financial institutions, where power, wealth, and influence converge in a symphony of economic prowess. Journey with us as we embark on an exploration of the captivating biography, ageless allure, towering heights, striking figures, immeasurable net worth, and beyond that define these enchanting bastions of global finance. Prepare to be enthralled as we unravel the intricacies that make London banks an indispensable pillar of the global economy.

Within the hallowed halls of London's world-renowned banks, unparalleled tales of ambition, innovation, and unparalleled success reside. Like a captivating symphony, these financial institutions reverberate with the complexities of intricate deals, meticulous investments, and the rhythmic dance of economic growth. Here, the titans of finance orchestrate monetary movements, their expertise resonating as they navigate the turbulent waters of international markets and seamlessly adapt to ever-evolving economic landscapes.

As we delve deeper into the realm of London banking, the heights to which these institutions soar stand as a testament to their unwavering dedication to excellence. Rising beyond the reaches of skyscrapers, London's banks pierce the heavens, their imposing presence serving as a stark reminder of the immense influence they wield. At dizzying altitudes, these towering edifices symbolize the colossal power and resolute stability that the London financial sector embodies.

Intriguing figures and numbers dance within the walls of these iconic institutions, mesmerizing all who dare to enter. With net worths that transcend the boundaries of imagination, London banks stand as epitomes of opulence and wealth creation. Within their labyrinthine corridors, fortunes are forged, destinies reshaped, and possibilities elevated. A tapestry of success, woven from countless threads of financial mastery, adorns the halls of these globally renowned establishments.

London Banks: A Comprehensive Overview

In this section, we delve into a detailed exploration of the dynamic and vibrant world of London banks. We will provide a comprehensive overview that goes beyond superficial knowledge and presents you with valuable insights into the renowned financial institutions that shape the landscape of this bustling global city.

- Leading Financial Hubs: Discover the pivotal role London banks play as one of the world's foremost financial centers, attracting top talent and facilitating international trade and investment.

- Established Institutions: Explore the rich history and legacy of London banks, tracing their origins back to centuries-old establishments that have stood the test of time.

- Innovative Practices: Learn about the cutting-edge approaches adopted by London banks, including their embrace of emerging technologies, forward-thinking strategies, and commitment to sustainable finance.

- Range of Services: Delve into the diverse range of services offered by London banks, from retail banking to corporate finance, investment banking, and wealth management, catering to a wide spectrum of clients.

- Global Reach: Recognize the global influence of London banks, with their extensive networks connecting them to markets and clients worldwide, ensuring their significant impact on the global economy.

- Regulatory Framework: Gain an understanding of the rigorous regulatory framework that governs London banks, ensuring stability, transparency, and accountability in the financial sector.

- Contributions to Society: Appreciate the role of London banks in supporting local communities through various initiatives and philanthropic efforts, contributing to the overall social and economic well-being of the city.

This section presents an all-encompassing view of London banks, shedding light on their multifaceted nature, significance, and impact. Whether you are a financial enthusiast, a prospective client, or simply curious about the inner workings of the financial world, this exploration will provide you with a comprehensive understanding of London banks and their pivotal role in shaping global finance.

The History of London Banks: From Medieval Times to Present Day

London banks have a rich and fascinating history that spans centuries, starting from the medieval era and continuing into the present day. Over the years, these financial institutions have played a crucial role in shaping the economy and commerce of the British capital.

Medieval Era: In the early days, during the medieval era, London's banking system was quite different from what it is today. There were no formal banking institutions, but rather individual moneylenders who provided financial services to the city's merchants and traders. |

The Birth of Modern Banking: It was during the 17th century that London banks began to take on a more modern form. The establishment of the Bank of England in 1694 marked a significant turning point in the city's banking history. This central bank played a pivotal role in stabilizing the economy and making London a major financial hub. |

The Industrial Revolution and Expansion: With the advent of the industrial revolution in the 18th century, London witnessed a boom in banking activities. The city became a center for investment and capital accumulation, attracting wealthy individuals and businesses from all over the world. |

Modernization and Global Influence: In the 20th century, London banks underwent further modernization and consolidation. They adapted to the changing financial landscape and played a vital role in financing international trade, investment banking, and wealth management. London became a global financial powerhouse. |

The Present Day: Today, London banks continue to thrive and adapt to the evolving financial landscape. They offer a wide range of services including retail banking, corporate banking, asset management, and more. London remains one of the world's leading financial centers, attracting investors and businesses from around the globe. |

London Banks' Role in the Global Financial Market

Exploring the significance of London's banks in the global financial market unveils a complex network of institutions that shape the world economy. Situated in one of the most influential financial hubs, these banks play a critical role in facilitating international trade, investment, and capital flow.

London's banks act as intermediaries, connecting businesses, individuals, and governments from various corners of the globe. Through their extensive networks and diverse financial services, they enable the smooth functioning of markets, providing vital liquidity and funding options for businesses and governments alike.

- Facilitating International Trade: London banks play a pivotal role in supporting international trade by offering trade finance services such as letters of credit and export financing. These services help mitigate risks associated with cross-border transactions, ensuring smooth trade flows between countries.

- Investment and Capital Management: London's renowned banks serve as financial powerhouses, offering comprehensive investment and capital management solutions. They provide a wide array of investment products, including equities, bonds, and derivatives, attracting both domestic and international investors seeking diversification and optimal returns.

- Asset Custody and Wealth Management: London banks excel in asset custody and wealth management services, assisting individuals and institutions in safeguarding their assets and achieving long-term financial goals. Their expertise in portfolio management, tax planning, and estate management makes them trusted partners in preserving and growing wealth.

- Financial Innovation and Research: As leaders in financial innovation, London banks drive advancements in financial products, technologies, and market practices. They conduct extensive research and analysis, offering valuable insights to investors, regulators, and policymakers, shaping the future of the global financial landscape.

- Risk Management and Compliance: London's banks adhere to stringent risk management practices and regulatory frameworks, ensuring the stability and integrity of the global financial system. They employ robust risk assessment techniques, implement anti-money laundering measures, and comply with international financial regulations, establishing trust and confidence in the market.

Collectively, London banks form a crucial part of the global financial ecosystem, influencing economic outcomes, fostering growth, and providing stability. Their role in facilitating economic transactions, managing risk, and promoting financial innovation cements their position as key players in the modern financial era.

Notable London Banks: A Closer Look at Their Contributions and Influence

In this section, we will delve into the remarkable London banks that have made significant contributions and exerted influential power in the financial landscape. These distinguished financial institutions have played a pivotal role in shaping the economic growth and stability of the global financial hub.

1. Bank of England: The Bank of England, often referred to as the "Old Lady of Threadneedle Street," stands as the central bank of the United Kingdom. Established in 1694, it holds a rich history of ensuring monetary stability, issuing currency, and regulating the country's financial system. Through its policies and decisions, the Bank of England has played a crucial role in guiding the nation's economy and maintaining confidence in the financial sector.

2. Barclays: As one of the largest banks in the world, Barclays has left an indelible mark on the London banking scene. With its diverse range of financial services, including personal banking, corporate banking, and investment management, Barclays has been instrumental in facilitating global trade and supporting businesses. The bank's innovative approach and commitment to customer satisfaction have earned it a reputation as a reliable and trustworthy financial institution.

3. HSBC: With its roots traced back to Hong Kong and Shanghai, HSBC has emerged as one of the most influential banks in London. Its extensive international network allows HSBC to connect businesses and individuals around the globe, contributing to London's status as a global financial center. As a leading provider of banking and financial services, HSBC has consistently demonstrated its commitment to promoting economic growth and fostering international trade.

4. Lloyds Banking Group: Lloyds Banking Group, a renowned name in the UK banking sector, has played a crucial role in supporting the country's economic development. With a strong emphasis on retail and commercial banking, Lloyds has helped individuals, small businesses, and larger corporations achieve their financial goals. Through its various subsidiaries, Lloyds Banking Group has provided essential financial services to millions of customers, contributing to the overall stability and growth of the London banking industry.

5. Standard Chartered: As a leading international bank with a significant presence in London, Standard Chartered has made notable contributions to the city's banking landscape. With a focus on emerging markets, particularly in Asia, Africa, and the Middle East, Standard Chartered has become a bridge between these regions and the global financial markets. The bank's expertise in facilitating international trade and financing infrastructure projects has positioned it as an influential player in London's banking sector.

- The Bank of England, established in 1694, assures monetary stability and regulatory oversight.

- Barclays, with its comprehensive range of financial services, supports global trade.

- HSBC, originating in Hong Kong and Shanghai, fosters international connections and economic growth.

- Lloyds Banking Group emphasizes retail and commercial banking to aid individuals and businesses alike.

- Standard Chartered acts as a bridge between emerging markets and global financial markets.

Exploring the Range of Financial Services Offered by Banks in the Vibrant City of London

In the bustling realm of London's financial institutions, banks play a pivotal role in providing a diverse range of services to meet the dynamic needs of individuals, businesses, and organizations. This section aims to delve into the extensive array of financial services offered by the esteemed banks scattered across the vibrant city.

Wealth Management: London banks excel in assisting clients with their diverse investment goals, offering tailored wealth management solutions and personalized advisory services to ensure financial growth and security.

Capital Markets: As a leading global financial hub, London banks serve as key players in facilitating capital market activities, including underwriting debt and equity securities, facilitating mergers and acquisitions, and providing expert insights on market trends.

Corporate Banking: Recognizing the unique demands of businesses, London banks offer an extensive range of corporate banking services, such as working capital management, trade finance, cash management, and commercial lending, to foster growth and financial stability.

Private Banking: London banks cater to high-net-worth individuals, delivering exclusive banking services that prioritize personalized attention, confidentiality, and an array of specialized financial products, including private wealth management, customized lending solutions, and premium lifestyle services.

International Banking: With London's prominence as an international financial hub, banks in the city provide comprehensive international banking services, including foreign exchange transactions, international trade financing, cross-border investment advice, and trade services, fostering seamless global transactions.

Retail Banking: London banks strive to meet the everyday banking needs of individuals through a spectrum of retail banking services, from basic personal accounts to comprehensive digital banking solutions, ensuring convenient access to their finances.

Asset Management: London banks excel in offering a range of asset management services, suiting various investment preferences, through actively managed funds, passive investment strategies, and portfolio management services, tailored to maximize returns and mitigate risks.

FinTech Innovations: Embracing the advancements in financial technology, London banks actively engage in innovative FinTech solutions, harnessing the power of digital transformation to provide efficient and user-friendly banking solutions, such as mobile banking, payment solutions, and online wealth management.

Islamic Banking: Recognizing the diversity of their clientele, London banks also cater to the specific requirements of Islamic finance, offering Sharia-compliant banking solutions, asset management services, and investment options that adhere to Islamic principles.

Through this diverse range of financial services, London banks continuously adapt and evolve, ensuring they remain at the forefront of the ever-changing financial landscape, and meeting the evolving needs of their diverse clientele.

FAQ

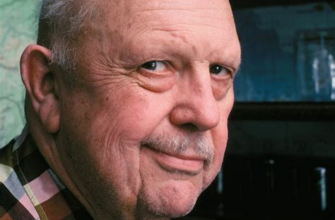

What is the biography of London Banks?

London Banks is a renowned figure in the banking industry. He has had a successful career spanning over three decades. Born and raised in London, he began his journey in the financial sector at a young age. Banks holds a degree in Finance from a prestigious university and has worked with several top-tier banks throughout his career.

Can you provide information about the age and height of London Banks?

London Banks, being a private individual, has not disclosed his exact age and height to the public. However, based on available information, it is estimated that he is in his late 40s or early 50s, and has an average height for a person of his age and stature.

What is the figure of London Banks?

The term "figure" in this context is not related to personal physical attributes. In the context of the article, "figure" refers to the financial standing of London Banks. As a successful banker, he has amassed substantial wealth and is considered to be a wealthy individual. However, the exact figure of his net worth is not publicly available.

Can you provide information about the net worth of London Banks?

While the article mentions London Banks' net worth, the exact amount is not specified. As a veteran in the banking industry and having worked with top financial institutions, it can be assumed that his net worth is substantial. However, without concrete information, it is difficult to provide an accurate figure.

What other information should I know about London Banks?

London Banks is not only known for his success in the banking industry but also for his philanthropic endeavors. He actively contributes to various charitable causes and is involved in community development projects. Banks has also authored several books on personal finance and investment. His expertise and knowledge make him a sought-after figure in the financial world.

What is the biography of London Banks?

London Banks is a successful banker who has made a name for himself in the financial industry. Born and raised in London, he completed his education in Economics and Finance from a prestigious university. He has worked in several renowned banks and has gained a wealth of experience in the field. He is known for his expertise in investment banking and has played a significant role in various high-profile deals.

How old is London Banks?

London Banks' exact age is not mentioned in the article. However, considering his education and experience in the banking industry, it can be assumed that he is in his late 30s or early 40s.